A couple of interesting observations I make in regards to the gold standard are the effects that ending convertibility had on the oil markets and real wages. President Richard M. Nixon officially closed the gold window in August 1971 and we have the data to analyze the results of that decision.

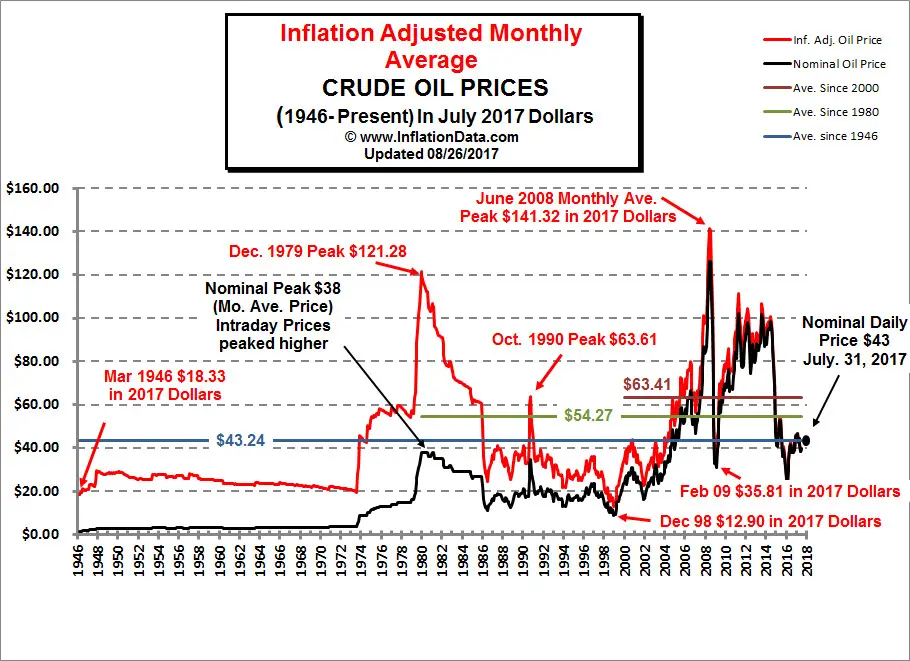

Here is a graph of oil prices ranging from the beginning of the post-war era to the present:

We can see that from 1946-on inflation adjusted oil prices actually were slightly deflationary. Around 1974 the price of gold took off, which makes sense when considering the fact that inflation takes several months to fully circulate throughout the economy and that the Bretton-Woods agreement originally had high hopes.

While Middle Eastern conflicts heavily effect oil prices, that (partially, Fed policy is also influential) accounts more for volatily than cumulative increases in prices. Switching to the fiat petro-dollar as the reserve currency for oil only invited price increases and unpredictability in the oil market.

Here is a graph of real wages and projected wages if tied to worker productivity, also post-war to the modern era:

From 1947-1972, wages were coupled with productivity. Nearly immediately afterwards, wages completely decoupled from productivity and have been downward or flat ever since. Hence, we have what is termed the "growing wealth gap" between the rich and the poor.

The conclusion we can draw from this is that inflation has eroded the purchasing power of the middle class, while the rich who receive the newly created money first are able to accumulate more wealth. Also, with a constantly unstable currency, it likely distorts the labor market in terms of determining what the real value of work is.

Americans are rightly upset about unaffordable oil prices and sticky wages. They should look to the gold

standard as the solution. I don't believe these graphs are simply a coincidence.

No comments:

Post a Comment

Please be kind and courteous.